Prop A: Estimated Impact

If approved, Proposition A is projected to provide approximately $56 million in additional operational revenue in the first year, with similar amounts expected annually.

Funding context

- Over the past five years, the district’s operating costs have increased by 21.3%, while the state’s basic allotment has increased by less than 1%.

- More than 30% of the projected Proposition A revenue (about $18.5 million) would come from the state.

- For every dollar collected locally, the district estimates receiving 35 cents in state funding.

Estimated homeowner impact

A GISD Resident, aged 64 and younger, with a $400,000 home with a homestead exemption, would have an estimated monthly increase of $3.77*.

*Based on current tax compression rates and the proposed $40,000 homestead exemption increase on top of the existing $100,000 exemption.

Property Tax Homestead Exemption Changes

On the Nov. 4 ballot, voters will have the opportunity to vote for state constitutional amendments that would

- increase the residential homestead exemption from $100,000 to $140,000 of the market value,

- raise the additional exemption for those aged 65+ or disabled from $10,000 to $60,000 of the market value of the individual's residence homestead, which, when combined with the residential homestead exemption, could provide eligible seniors or disabled homeowners with up to $200,000 of exempted value.

If approved statewide, the additional exemption would save the average district homeowner about $420 annually.

Exemptions for Over 65 and Disabled (Tax Ceiling)

- State law mandates a tax ceiling for school district property taxes for homeowners who have been granted the over-65 or disabled person exemption.

- Proposition A would not increase school taxes above the ceiling amount, unless home improvements or additions are made.

- Eligible homeowners must apply for these exemptions through their local appraisal district. The residence homestead exemption form can be found by searching for your property on the appraisal district's website.

100% Disabled Veterans

- Property owners who have been granted the Disabled Veteran with 100% Disability exemption receive a total (100%) exemption of appraised value on their residence homestead.

- Proposition A will not increase the school taxes; the annual tax levy will remain $0.00.

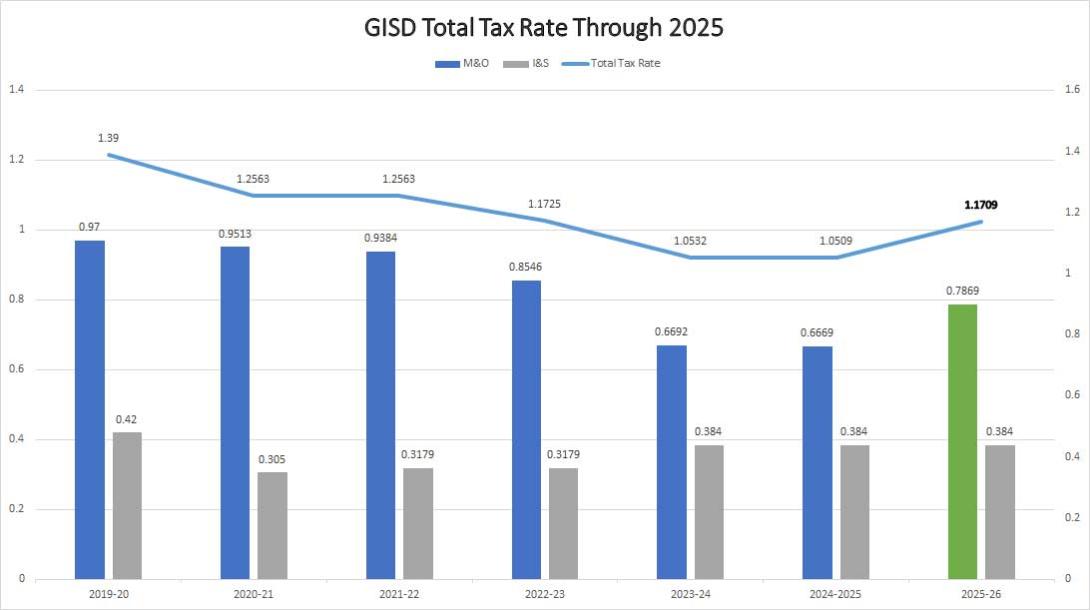

Financial snapshot

- Current M&O tax rate: $0.7869

- Per-pupil expenditure: $10,764

- Bond ratings: Aa1 (Moody’s), AA (Standard & Poor’s), AA+ (Fitch)

Figure 1: Graph showing GISD's total tax rate from 2019-20 through 2025 - See text description of graph

| District | M&O Tax Rate |

|---|---|

| Plano ISD | 0.8405 |

| Arlington ISD | 0.8249 |

| Richardson ISD | 0.7931 |

| Forney ISD | 0.7892 |

| Dallas ISD | 0.7718 |

| Frisco ISD | 0.7575 |

| Grand Prairie ISD | 0.7575 |

| Wylie ISD | 0.7575 |

| Mesquite ISD | 0.6992 |

| Garland ISD* | 0.6692 |

| Rockwall ISD* | 0.6692 |

*Districts that have not passed a Prop A voter-approved tax rate election that funds maintenance & operations (M&O).